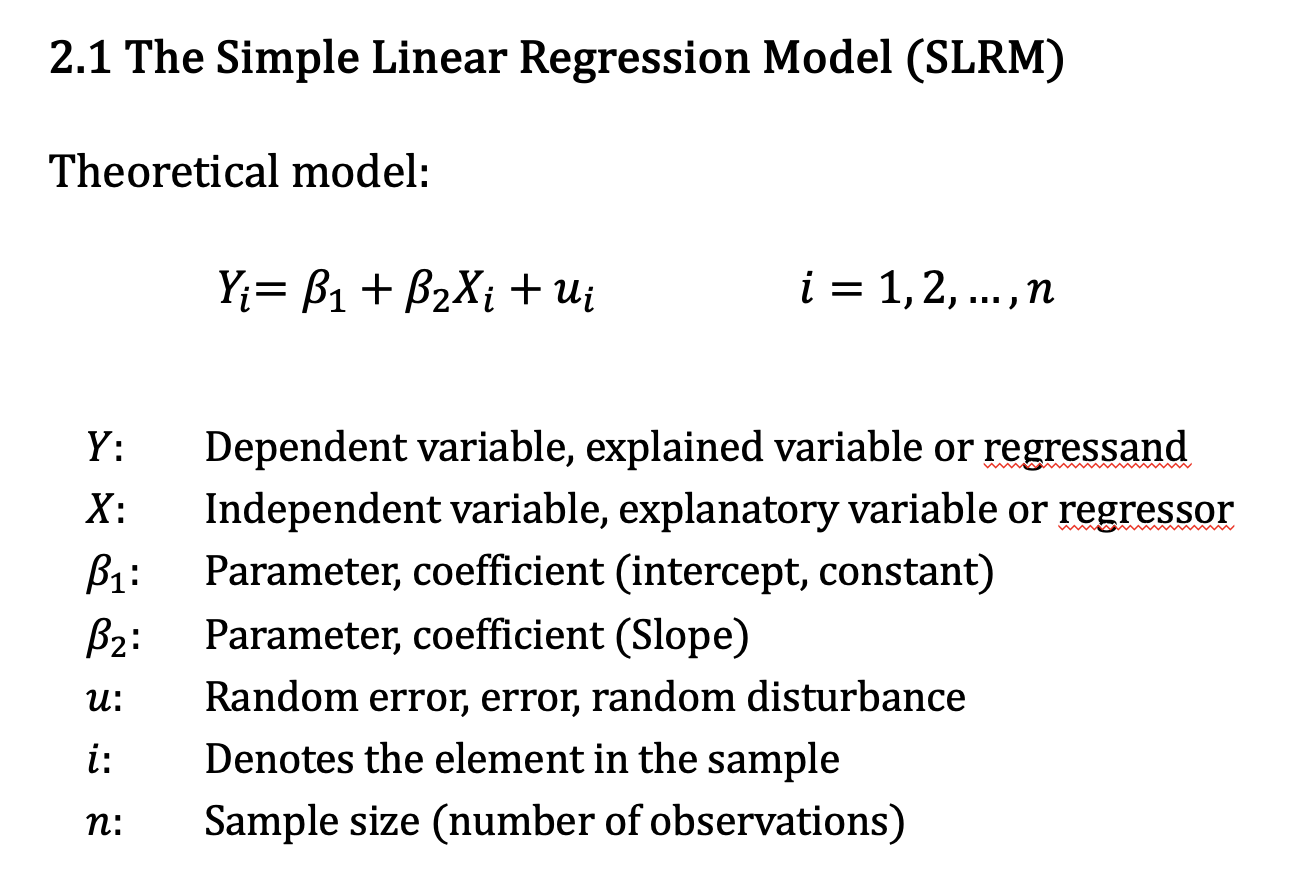

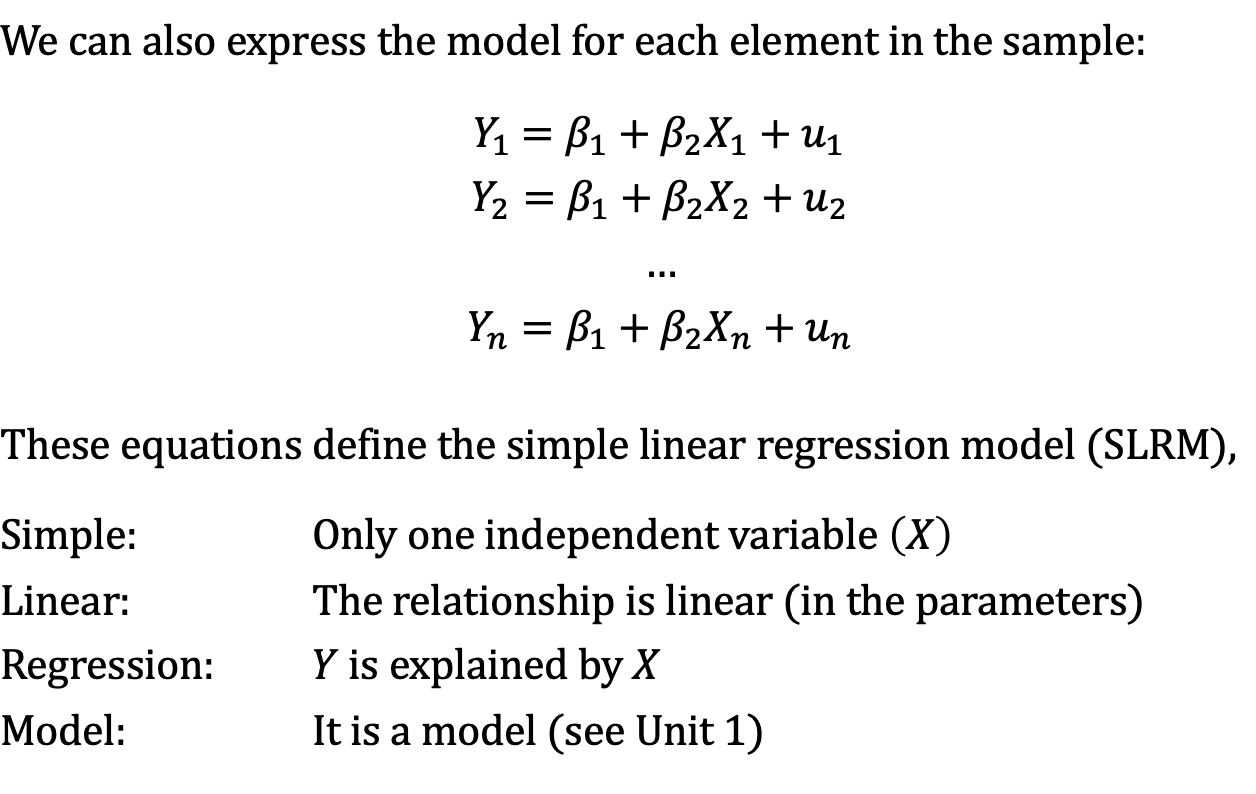

Loading... > 这是一篇课堂笔记,仅做存档。 # Unit 1 Introduction Econometrics: From Measurement, Quantitative Methods, **Statistical Methods** to Regression. ## Goals of Econometrics 1. Quantify the relationships among different variables 2. Measure the impact and consequence of economic decisions 3. Forecast economic variables **Econometric models:** simple representation of a phenomenon. The model is with stochastic (random, which is not fixed) elements. ## Steps in econometric model **Specification**. One must specify or build the econometric model. **Estimation**. One must estimate the econometric model. No true values would be known in a model. **Validation**. One must verify that the model is ‘good’. For a parameter β, you could only know the estimated value , and the β could be reached out by sample data. ## Data **Time-series data**: Data corresponding to a certain element over time. For example, the inflation rate of Belgium from 2010 to 2020 is a time-series data. **Cross-section data**: Data corresponding to different elements for a certain moment in time. The inflation rate of Belgium, Portugal and France in 2024 is a cross-section data. **Panel data**: Combination of both time-series and cross-section data (data for different elements and for different moments in time) The inflation rate of Belgium, Portugal and France from 2010 to 2020. Depending on the types of data, we could use different methods. # Simple Linear Regression Model ## Theoretical model   $$ Y_1= \beta_1 + \beta_2X_1+ u_1 $$ 在这里,Y1是实际值。 接下来,我们的重点是寻找合适的$\beta_2$。假如$\beta_2$是正数,我们认为两者存在正相关。 $$ \hat{u_i}=Y_i-\hat{Y_i},i=1,2,3,...,n $$ 这里的 $\hat{u_i}$ 代表着残差(residual),它是第i个实际值与预测值的差,不同于$u_i$,那个是随机误差(Random Error)。 ## Estimation of the Model 我们通常使用最小化残差平方和(minimizing the sum of squared vertical distances from the points)的方法建立回归。也就是最小化每个点到回归直线的垂直距离平方和。这是为了规避正负值的抵消。当然我们也可以使用最小化残差绝对值和的方法,不过那样的话将会难以计算。 $$ Minimize \sum_{i=1}^{n}\hat{u_i}^2 $$ 下面开始推导。不难发现, $$ \sum_{i=1}^{n}\hat{u_i}^2=\sum_{i=1}^{n}(Y_i-\hat{Y_i})^2=\sum_{i=1}^{n}(Y_i-\hat{\beta_1}-\hat{\beta_2}X_2)^2 $$ 为了使得$\sum_{i=1}^{n}(Y_i-\hat{\beta_1}-\hat{\beta_2}X_2)^2$最小,我们对$\beta_1$ 和$\beta_2$求偏导。 $$ \frac{\partial{\sum_{i=1}^{n}\hat{u_i}^2}}{\partial{\hat{\beta_1}}}=0 $$ $$ \frac{\partial{\sum_{i=1}^{n}\hat{u_i}^2}}{\partial{\hat{\beta_2}}}=0 $$ 展开,得到 $$ \hat{\beta_2} = \frac{\sum_{i=1}^{n}(X_i-\bar{X})\times(Y_i-\bar{Y})}{\sum_{i=1}^{n}(X_i-\bar{X})^2} \\ $$ $$ \hat{\beta_1}=\bar{Y}-\hat{\beta_2}\cdot\bar{X} $$ 我们观察$\beta_2$,可以发现 $$ \frac{\sum_{i=1}^{n}(X_i-\bar{X})\times(Y_i-\bar{Y})}{n}= Cov(X,Y) $$ $$ \frac{\sum_{i=1}^{n}(X_i-\bar{X})^2}{n}=Var(X) $$ 所以 $$ \hat{\beta_2} = \frac{\sum_{i=1}^{n}(X_i-\bar{X})\times(Y_i-\bar{Y})}{\sum_{i=1}^{n}(X_i-\bar{X})^2} = \frac{\frac{\sum_{i=1}^{n}(X_i-\bar{X})\times(Y_i-\bar{Y})}{n}}{\frac{\sum_{i=1}^{n}(X_i-\bar{X})^2}{n}}=\frac{Cov(X,Y)}{Var(X)} $$ 最后修改:2025 年 09 月 24 日 © 禁止转载 赞 如果觉得我的文章对你有用,请随意赞赏